In this article

We discuss why companies target both Africa and Europe, Amsterdam’s submarine cable infrastructure to African markets, realistic latency numbers from Amsterdam to major African cities, cost comparisons between single and dual deployments, use cases that work well from Amsterdam, honest assessment of when you need African infrastructure, and how to implement Africa-Europe delivery from OpenMetal’s Amsterdam location.

Your streaming platform has users in Lagos and London. Your fintech app processes payments in Nairobi and Paris. Your gaming servers need to reach players in Johannesburg and Berlin. If you’re in any of these situations, you need infrastructure that serves both continents, but deploying in multiple locations doubles your complexity and costs.

Most companies assume they need data centers on both continents to serve users well. Deploy in Europe for European traffic, deploy in Africa for African traffic. This seems logical until you look at the actual infrastructure landscape, latency realities, and cost implications.

Amsterdam offers a different approach. Through extensive submarine cable connections, Amsterdam data centers can effectively serve both European and African markets from a single location. This is based on physical cable infrastructure connecting Amsterdam to major African cities with latency that works for most applications.

This guide examines why Amsterdam works as a single deployment point for Africa-Europe traffic, when this approach makes sense, and when you actually need infrastructure on both continents.

Why Companies Need to Serve Both Africa and Europe

Before diving into infrastructure solutions, let’s discuss why companies increasingly need presence in both markets.

Africa’s Digital Growth Creates Opportunity

Africa represents one of the world’s fastest-growing internet markets. The numbers tell a compelling story:

Internet penetration: Africa’s internet penetration reached 43% in 2024 and continues growing rapidly. This represents over 600 million internet users, with penetration rates accelerating as mobile networks expand and smartphone costs decrease.

Mobile-first market: Africa leapfrogged desktop internet directly to mobile. Over 80% of African internet users access services exclusively through mobile devices. This creates opportunities for companies building mobile-first products.

Young population: Africa has the world’s youngest population, with median age around 19 years. This demographic is digitally native and adopts new technologies quickly once infrastructure reaches them.

Economic growth: Multiple African economies are growing faster than developed markets. Nigeria, Kenya, Ghana, Egypt, and South Africa represent substantial markets with growing middle classes that can afford digital services.

Payment infrastructure improving: Mobile money adoption in Africa leads the world. M-Pesa in Kenya processes billions in transactions. This solves the payment problem that historically blocked digital services in African markets.

European Connection to African Markets

European and African markets are deeply connected:

Diaspora communities: Millions of Africans live in Europe. They send remittances home, consume content from home countries, and use services bridging both continents. A fintech app serving Nigerian diaspora in London needs infrastructure reaching both markets.

Colonial and linguistic ties: Former colonial relationships created lasting connections. Francophone African countries maintain strong ties to France. Anglophone countries connect to UK markets. These relationships drive business relationships and service needs.

Business relationships: European companies operate extensively in Africa. African companies expand to European markets. B2B services need to serve users in both locations.

Content consumption patterns: African users consume European content (sports, entertainment, news). European users with African connections consume African content. Streaming and media platforms need to serve both directions.

The Multi-Market Challenge

Companies serving both continents face specific challenges:

Latency requirements: Real-time applications need low latency. Gaming, video calls, financial transactions, and interactive applications all suffer when latency exceeds certain thresholds.

Infrastructure costs: Deploying in multiple locations multiplies costs. You need servers, bandwidth, management overhead, and operational complexity in each location.

Content synchronization: If you deploy in multiple locations, you need to keep data synchronized. This adds complexity and potential consistency issues.

African data center limitations: While improving, African data center infrastructure lags behind European options in cost, reliability, and connectivity. This makes African deployment more expensive and complex than European deployment.

Regulatory complexity: Different countries have different data residency and compliance requirements. Single-location deployment simplifies compliance when possible.

Amsterdam’s Submarine Cable Infrastructure

Amsterdam’s effectiveness for serving African markets comes from physical infrastructure – submarine cables connecting Europe to Africa.

Major Cables Connecting Amsterdam to Africa

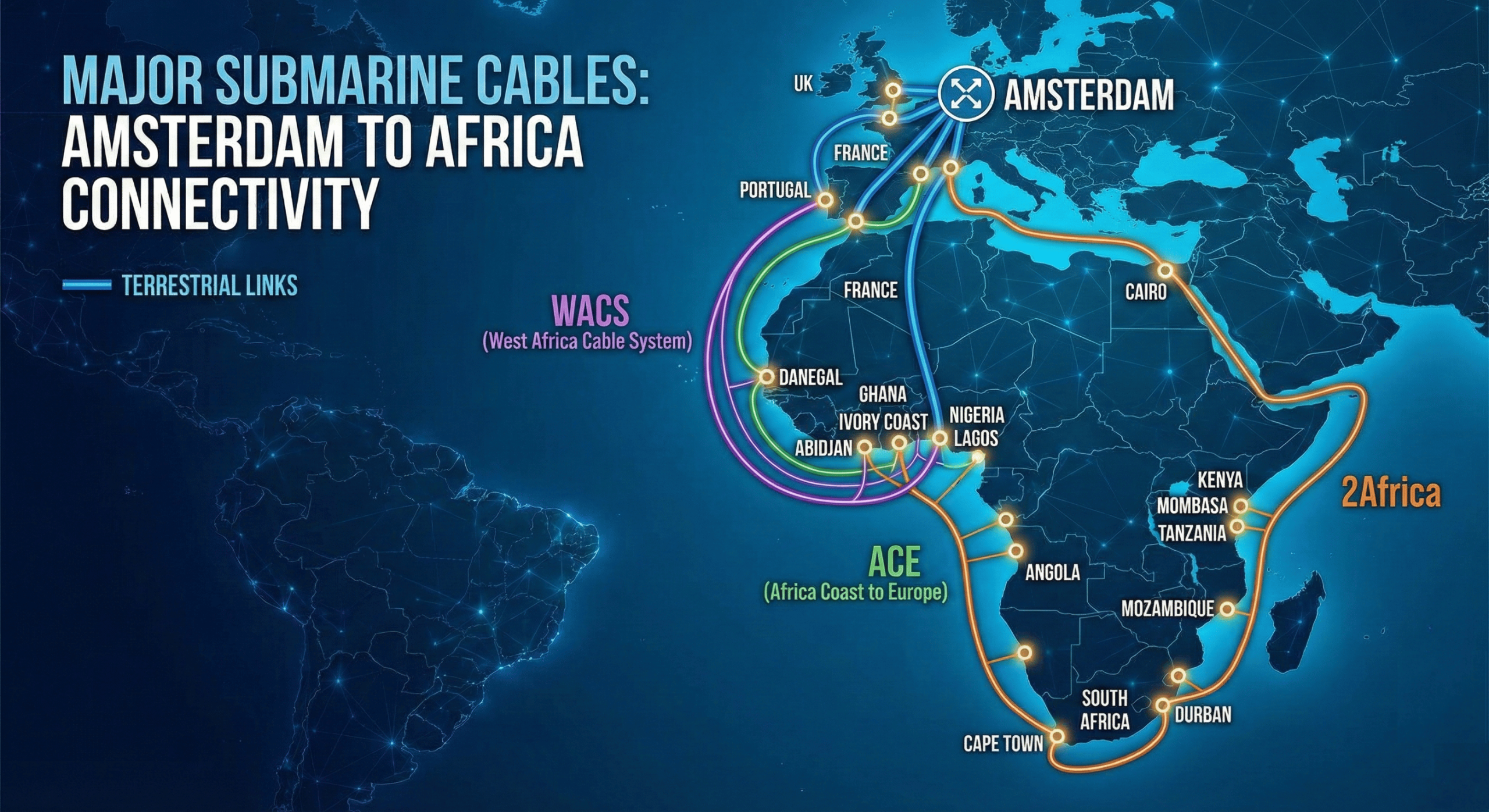

Multiple submarine cable systems connect Amsterdam (and nearby European landing points) to African markets:

West Africa Cable System (WACS): Connects Europe to South Africa via West African countries. This 14,530 km cable system lands in Portugal (which connects to Amsterdam via terrestrial routes) and serves Nigeria, Ghana, Ivory Coast, and other West African nations before reaching South Africa.

Africa Coast to Europe (ACE): This cable specifically connects West African countries to France (which has excellent connectivity to Amsterdam). It serves 24 countries along Africa’s western coast.

SAT-3/WASC/SAFE: One of the earliest cables connecting Europe to Africa and Asia. Connects Portugal to South Africa via West African coastal nations.

2Africa: Meta’s massive cable project, announced for completion through 2024-2026, will be the longest submarine cable system ever deployed at 45,000 km. It connects Europe to Africa extensively, with multiple landing points in African countries and direct connections to European hubs including Amsterdam region.

PEACE Cable: Connects Europe to Asia via East Africa. While not Amsterdam-focused, it improves overall African connectivity to global networks that Amsterdam connects to.

How Submarine Cables Work for Content Delivery

Understanding submarine cable infrastructure helps clarify why Amsterdam works for African traffic:

Landing points matter: Submarine cables don’t go directly from city to city. They land at coastal points, then connect inland via terrestrial networks. Amsterdam benefits from being a major European internet exchange point with excellent connectivity to cable landing points in UK, France, and Portugal.

Multiple paths provide redundancy: Africa connects to Europe through multiple cable systems. If one cable has issues, traffic routes through alternatives. Amsterdam’s position at the heart of European networks means it has access to multiple paths to African destinations.

Internet exchange points: Amsterdam hosts AMS-IX, one of the world’s largest internet exchange points. This means networks from around the world (including African ISPs) peer in Amsterdam. Traffic between Amsterdam and African destinations often has direct peering relationships rather than bouncing through multiple intermediaries.

Terrestrial connections: Amsterdam connects to submarine cable landing points via high-capacity terrestrial fiber. The Netherlands has some of Europe’s best fiber infrastructure, making Amsterdam-to-landing-point latency minimal.

African Landing Points and Connectivity

Where cables land in Africa determines which African markets are well-served:

West Africa: Nigeria (Lagos), Ghana (Accra), Ivory Coast (Abidjan), Senegal (Dakar) have good submarine cable connectivity to Europe. These markets have multiple cable systems providing redundancy.

North Africa: Egypt (Cairo/Alexandria), Morocco (Casablanca) have excellent connectivity to Europe due to Mediterranean proximity. These are often the best-connected African markets.

East Africa: Kenya (Mombasa), Tanzania (Dar es Salaam) connect to Europe via cables around the African coast. Latency is higher than West/North Africa but still reasonable.

Southern Africa: South Africa (Cape Town, Durban) has good connectivity via multiple cable systems running down Africa’s western and eastern coasts.

Inland markets: Countries without coastal access depend on terrestrial connections to submarine cable landing points. These markets have higher latency and may benefit more from in-country infrastructure.

Latency Analysis: Amsterdam to African Cities

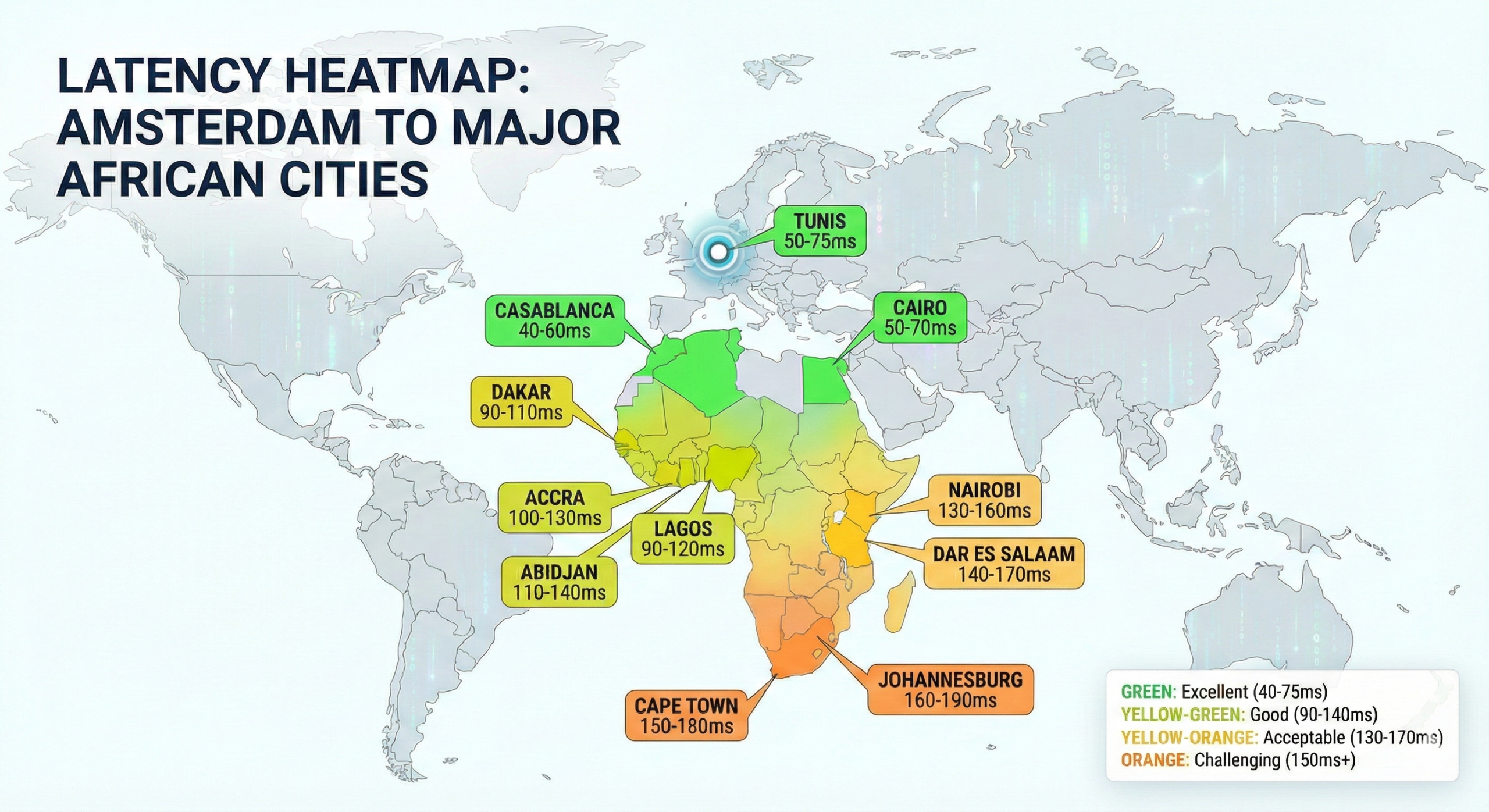

Let’s examine actual latency numbers from Amsterdam to major African markets. These are real-world measurements, not theoretical calculations.

North Africa (Best Connectivity)

Cairo, Egypt:

- Typical latency from Amsterdam: 50-70ms

- Cable route: Via Mediterranean cables

- Population served: 20+ million in greater Cairo

- Assessment: Excellent for most applications including real-time

Casablanca, Morocco:

- Typical latency from Amsterdam: 40-60ms

- Cable route: Via Spain/Mediterranean

- Population served: 4+ million in greater Casablanca

- Assessment: Excellent for all applications

Tunis, Tunisia:

- Typical latency from Amsterdam: 50-75ms

- Cable route: Via Mediterranean cables

- Population served: 2+ million in greater Tunis

- Assessment: Very good for most applications

West Africa (Good Connectivity)

Lagos, Nigeria:

- Typical latency from Amsterdam: 90-120ms

- Cable route: Via WACS, ACE, SAT-3

- Population served: 15+ million in Lagos, 220+ million in Nigeria

- Assessment: Good for most applications, acceptable for real-time

Accra, Ghana:

- Typical latency from Amsterdam: 100-130ms

- Cable route: Via multiple West Africa cables

- Population served: 2+ million in greater Accra

- Assessment: Good for standard applications, marginal for competitive gaming

Dakar, Senegal:

- Typical latency from Amsterdam: 90-110ms

- Cable route: Via ACE and other West Africa cables

- Population served: 3+ million in greater Dakar

- Assessment: Good for most applications

Abidjan, Ivory Coast:

- Typical latency from Amsterdam: 110-140ms

- Cable route: Via West Africa cables

- Population served: 5+ million in greater Abidjan

- Assessment: Acceptable for standard applications

East Africa (Moderate Connectivity)

Nairobi, Kenya:

- Typical latency from Amsterdam: 130-160ms

- Cable route: Around African coast or through Egypt

- Population served: 4+ million in greater Nairobi

- Assessment: Acceptable for standard applications, challenging for real-time

Dar es Salaam, Tanzania:

- Typical latency from Amsterdam: 140-170ms

- Cable route: Coastal cables around Africa

- Population served: 5+ million in greater Dar es Salaam

- Assessment: Workable for non-real-time applications

Southern Africa (Longer Routes)

Johannesburg, South Africa:

- Typical latency from Amsterdam: 160-190ms

- Cable route: Via West or East coast cables

- Population served: 5+ million in greater Johannesburg, gateway to 60+ million in South Africa

- Assessment: Challenging for real-time, workable for non-time-sensitive

Cape Town, South Africa:

- Typical latency from Amsterdam: 150-180ms

- Cable route: Via West coast cables (slightly shorter than to Johannesburg)

- Population served: 4+ million in greater Cape Town

- Assessment: Similar to Johannesburg

What These Numbers Mean for Applications

Understanding how latency impacts different application types:

Excellent (<50ms):

- Competitive gaming works well

- Real-time financial trading

- Video conferencing with imperceptible lag

- Interactive applications feel instant

Good (50-100ms):

- Most gaming works (except competitive FPS)

- Video conferencing works well

- Real-time collaboration tools work

- Interactive websites feel responsive

Acceptable (100-150ms):

- Casual gaming works

- Video conferencing has noticeable but acceptable lag

- Website interactions work but feel slightly delayed

- Most business applications work fine

Challenging (>150ms):

- Competitive gaming becomes difficult

- Video conferencing lag is noticeable

- Interactive applications feel sluggish

- May need optimization or CDN caching

Based on these thresholds, Amsterdam works well for North and West African markets (where most African internet users live). East and Southern Africa have higher latency but still workable for many applications.

Cost Comparison: Single Amsterdam vs Dual Deployment

Let’s examine the real economics of serving Africa and Europe from one location versus two.

Single Amsterdam Deployment

OpenMetal Amsterdam Infrastructure:

OpenMetal’s Large V4 and XL V4 Cloud Cores are the optimal choices for Africa-Europe deployment, with excellent availability in Amsterdam.

Large V4 Cloud Core (Recommended):

- Monthly cost: $4,298.40

- Capacity: 1,296 vCPUs, ~142 VMs

- Bandwidth: 3,797TB included

- Most popular for multi-continent deployment

- Serves both European and African traffic from one location

XL V4 Cloud Core (High-Capacity):

- Monthly cost: $7,149.60

- Capacity: 2,736 vCPUs, ~293 VMs

- Bandwidth: 5,695TB included

- Excellent for bandwidth-intensive applications

- Handles substantial traffic to both continents

Advantages:

- Single infrastructure stack to manage

- One set of VMs, databases, applications

- No data synchronization complexity

- Included bandwidth handles both continents generously

- Operational simplicity

- Readily available in Amsterdam

Annual cost for Large V4: $51,580.80

Annual cost for XL V4: $85,795.20

Dual Deployment (Amsterdam + Africa)

Deploying in both locations requires:

Amsterdam (for European traffic):

- Medium V4 Cloud Core: $2,376/month

- Serves European users

African Location Options:

Unfortunately, OpenMetal doesn’t currently have African data center locations. To deploy in Africa, you’d need alternative providers with significantly different pricing structures:

Typical African Cloud Costs:

- African cloud infrastructure typically costs 2-3x more than European equivalent

- Bandwidth in Africa costs 5-10x more than European bandwidth

- Options include: AWS Africa (Cape Town), Azure South Africa, or local African providers

- Estimated cost: $8,000-15,000/month for equivalent capacity

Additional Complexity Costs:

- Data synchronization infrastructure

- Monitoring across two platforms

- Engineering time managing two deployments

- Operational overhead: ~$3,000-5,000/month equivalent

Total dual deployment annual cost: $150,000-240,000

Savings with single Amsterdam deployment: $98,000-188,000 annually

When Cost Savings Matter Most

The economics favor Amsterdam single deployment particularly for:

Mid-market companies: Companies with $5-50M revenue where infrastructure costs materially impact margins

Bandwidth-intensive applications: Streaming, content delivery, large file transfers where African bandwidth costs multiply quickly

Early market entry: Testing African markets before committing to full African infrastructure

Diaspora-focused services: When substantial user base is in Europe but needs to serve African connections

Cross-continent applications: Services where users in both locations interact with same data

Use Cases That Work Well from Amsterdam

Let’s examine specific applications that work effectively serving Africa from Amsterdam infrastructure.

Streaming and Content Delivery

Video streaming platforms:

- Pre-recorded content works well with 100-150ms latency

- Adaptive bitrate handles variable network conditions

- CDN caching at network edges reduces perceived latency

- Example: Educational video platform serving African students and European diaspora

Audio streaming:

- Music and podcasts are latency-tolerant

- Works well even with 150ms+ latency

- Example: African music streaming service with European audience

Implementation approach:

- Host origin servers in Amsterdam

- Use CDN with African edge locations for caching

- Amsterdam handles authentication, user data, content management

- Edge locations handle video delivery

Fintech and Payments

Remittance services:

- Europe-to-Africa money transfers

- Latency under 150ms acceptable for non-real-time transfers

- Example: Service for Nigerian diaspora in UK sending money home

Mobile money platforms:

- Account management and balance queries work well

- Transaction processing acceptable with 100ms latency

- Example: Pan-African mobile wallet with European operations

Banking applications:

- Account access and management

- Non-trading financial services

- Example: Digital bank serving African markets with European headquarters

Implementation approach:

- Database in Amsterdam for unified view

- Transaction processing handles latency well

- Use queuing for non-time-critical operations

- Focus on reliability over absolute speed

SaaS and Business Applications

Business management software:

- CRM, ERP, project management

- Latency under 150ms acceptable for business software

- Example: African SMB management software used by European consultants

Collaboration tools:

- Document management

- Asynchronous collaboration

- Email and messaging

- Example: Business collaboration platform for Africa-Europe teams

E-commerce platforms:

- Online storefronts and marketplaces

- Shopping cart and checkout

- Example: African products marketplace selling to European customers

Implementation approach:

- Application servers in Amsterdam

- Database replication if needed

- Caching layer for frequently accessed data

- Optimize queries to minimize round trips

Gaming (Non-Competitive)

Casual mobile games:

- Turn-based games

- Puzzle games

- Strategy games without real-time requirements

- Example: Mobile game popular in both African and European markets

Social casino games:

- Slots, poker, bingo

- Latency under 150ms acceptable

- Example: Social gaming platform with African and European players

What doesn’t work well:

- Competitive FPS games need <50ms

- Fighting games need extremely low latency

- Real-time strategy competitive games

- These need local infrastructure

Implementation approach:

- Game servers in Amsterdam

- Regional matchmaking to group players by location

- Compensate for latency in game design

- Use client-side prediction

Media and Publishing

News websites:

- Article publishing and content management

- Comments and user engagement

- Example: Pan-African news site with European readership

Blogs and content sites:

- Static content delivery

- Content management systems

- Example: African culture and lifestyle content for global audience

Digital magazines:

- Publication platforms

- Subscription management

- Example: African business magazine with European subscribers

Implementation approach:

- Static content via CDN with African edge presence

- Dynamic content from Amsterdam

- Optimize images and assets for mobile

- Progressive loading for slower connections

When Amsterdam Isn’t Enough

Being honest about limitations helps companies make informed decisions. Amsterdam single-location deployment doesn’t work well for every use case.

Applications Requiring <100ms Latency

Competitive gaming:

- First-person shooters, fighting games, MOBAs

- Players in Southern/East Africa need local infrastructure

- West/North Africa might work from Amsterdam

- Consider: Deploy game servers in South Africa for competitive players

Real-time financial trading:

- High-frequency trading needs <10ms latency

- Even standard trading benefits from <50ms

- Consider: Use African data centers for trading operations

Live video streaming:

- Live sports, esports, interactive streaming

- Latency under 2 seconds important for live interaction

- Consider: Use regional streaming infrastructure with Amsterdam as backup

Regulatory Requirements

Data residency laws:

- Some African countries require data stay in-country

- South Africa has data protection laws with residency implications

- Nigeria has data localization discussions ongoing

- Consider: Deploy in-country if required by law or customer contracts

Government and public sector:

- Government contracts often require local infrastructure

- Public sector data may need to stay in-country

- Consider: Use local providers for government work

Markets with Poor International Connectivity

Inland African countries:

- Countries without submarine cable access

- Markets with poor terrestrial connections to coastal cable landing points

- Consider: Use local providers or accept higher latency

Areas with network congestion:

- Some African ISPs have congested international links

- Domestic routing may be faster than international

- Consider: Test actual performance in target markets

When Scale Justifies Multi-Location

Large user bases:

- If you have millions of users in specific African markets

- At sufficient scale, dedicated African infrastructure pays for itself

- Consider: Start in Amsterdam, add African location as you grow

Very high bandwidth requirements:

- If serving massive amounts of video or data to African users

- International bandwidth costs may justify local caching/serving

- Consider: Hybrid approach with Amsterdam origin and African edge presence

Implementing Africa-Europe Delivery from Amsterdam

Here’s how to actually deploy infrastructure serving both continents from Amsterdam.

Step 1: Assess Your Requirements

Before deploying, understand your specific needs:

Latency requirements:

- What’s acceptable for your application?

- Test with users in target African markets

- Measure actual performance, don’t assume

Target markets:

- Which African countries matter most?

- North/West Africa work better from Amsterdam

- East/South Africa have higher latency

Traffic distribution:

- What percentage of traffic is European vs African?

- This affects capacity planning

- Informs CDN strategy

Data residency:

- Do you have regulatory requirements?

- Check specific country regulations

- Plan compliance approach

Step 2: Deploy Amsterdam Infrastructure

OpenMetal’s Amsterdam data center provides the foundation, with Large V4 and XL V4 configurations offering the best balance of capacity and availability for Africa-Europe deployment.

Recommended configurations:

Large V4 Cloud Core (Most Popular for Africa-Europe):

- Monthly cost: $4,298.40

- Capacity: 1,296 vCPUs, ~142 VMs

- Bandwidth: 3,797TB included

- Best for: Production deployments serving both continents

- Why it works: Ample capacity for multi-continent traffic, generous bandwidth handles African and European users, proven for content delivery and SaaS applications

XL V4 Cloud Core (High-Capacity Option):

- Monthly cost: $7,149.60

- Capacity: 2,736 vCPUs, ~293 VMs

- Bandwidth: 5,695TB included

- Best for: Large-scale operations, bandwidth-intensive applications

- Why it works: Handles substantial traffic to both markets, ideal for streaming platforms and high-traffic services

Alternative for testing:

- Medium V4 Cloud Core: $2,376/month

- Good for: Market validation before production deployment or smaller production needs

- Consider upgrading to Large V4 for production scale

For specialized needs:

- XXL V4 Cloud Core: $10,238.40/month

- Best for: Very high-traffic applications requiring maximum capacity

Most companies serving Africa and Europe find the Large V4 Cloud Core provides the optimal balance of capacity, bandwidth, and cost-effectiveness. The included 3,797TB bandwidth easily handles mixed European and African traffic for typical applications.

All configurations include:

- OpenStack for cloud management

- Ceph distributed storage

- 45-second deployment to production

- Full root access for optimization

Step 3: Optimize for African Connectivity

Even with Amsterdam infrastructure, optimize specifically for African traffic:

Network optimization:

- Test routes to major African ISPs

- Use BGP to optimize routing paths

- Consider transit providers with good African connectivity

Content optimization:

- Compress images and assets aggressively

- Use modern formats (WebP, AVIF) for smaller sizes

- Minimize requests and round trips

- Implement progressive loading

Caching strategy:

- Cache aggressively for African traffic

- Long cache times for static content

- Use service workers for offline capability

- Consider CDN with African edge locations

Application optimization:

- Minimize database round trips

- Batch operations when possible

- Use connection pooling

- Implement retry logic for flaky connections

Step 4: Add CDN for Edge Caching

While origin servers run in Amsterdam, CDN provides edge caching closer to users:

CDN providers with African presence:

- Cloudflare has edge locations in South Africa, Kenya, Nigeria

- Akamai has African edge presence

- Regional CDNs like WIOCC serve African markets

Implementation approach:

- Origin servers in Amsterdam

- CDN caches content at African edges

- Static assets served from edge

- Dynamic content from Amsterdam origin

Cost considerations:

- CDN adds cost but improves experience

- Calculate based on traffic patterns

- May be worth it for bandwidth-heavy applications

Step 5: Monitor Performance Across Regions

Track performance in both European and African markets:

Metrics to monitor:

- Latency by country and city

- Bandwidth utilization patterns

- Error rates by region

- User experience metrics

Tools and approaches:

- Real user monitoring in African markets

- Synthetic monitoring from African locations

- Track performance degradation

- Set alerts for regional issues

Optimization cycle:

- Measure baseline performance

- Identify bottlenecks

- Implement improvements

- Measure results

Step 6: Plan for Growth

As your service grows, infrastructure needs evolve:

Scaling in Amsterdam:

- Start with Medium or Large configuration

- Scale to XL or XXL as traffic grows

- Add additional Cloud Cores if needed

- OpenMetal makes scaling straightforward

When to add African infrastructure:

- If African traffic exceeds 50% of total

- If latency becomes limiting factor

- If scale justifies dedicated infrastructure

- If regulatory requirements demand it

Hybrid approach:

- Keep Amsterdam as primary

- Add African edge locations strategically

- Use Amsterdam for data/authentication

- Use African locations for content delivery

OpenMetal Amsterdam Infrastructure Details

Let’s examine specific infrastructure available in Amsterdam for Africa-Europe deployment.

Facility Specifications

OpenMetal’s Amsterdam data center is located in a Digital Realty facility with:

Power and cooling:

- N+1 UPS power redundancy

- N+1 cooling redundancy

- Energy-efficient modular architecture

- 100% renewable energy operation

Connectivity:

- Carrier-neutral facility

- Direct access to 4 internet exchange points

- AMS-IX certified connectivity

- Dual-entry fiber from separate carrier routes

Security and compliance:

- 24×7 on-site security personnel

- Comprehensive monitoring

- Multiple compliance certifications

- European data protection standards

Location advantages:

- 10 minutes from Schiphol Airport

- Central European location

- Major financial and tech hub

- Excellent terrestrial connectivity

Available Configurations

OpenMetal’s Amsterdam bare metal servers and private cloud cores are optimized for multi-continent deployment. Large V4 and XL V4 Cloud Cores are the most readily available and best suited for Africa-Europe traffic patterns.

Large V4 Cloud Core: $4,298.40/month (Recommended)

- 1,296 vCPUs, ~142 VMs

- 3,797TB monthly bandwidth

- Most popular choice for Africa-Europe deployment

- Readily available in Amsterdam

- Ideal for: Production SaaS, streaming platforms, content delivery, fintech applications

- Handles: 100,000-500,000 users across both continents

XL V4 Cloud Core: $7,149.60/month (High-Capacity)

- 2,736 vCPUs, ~293 VMs

- 5,695TB monthly bandwidth

- Excellent availability in Amsterdam

- Best for: Bandwidth-intensive applications, large user bases

- Ideal for: Video streaming, large-scale content delivery, high-traffic platforms

- Handles: 500,000+ users across both continents

Alternative configurations:

Medium V4 Cloud Core: $2,376/month

- 1,008 vCPUs, ~66 VMs

- 1,898TB monthly bandwidth

- Good for: Testing markets, smaller deployments

XXL V4 Cloud Core: $10,238.40/month

- 2,784 vCPUs, ~557 VMs

- 9,491TB monthly bandwidth

- Good for: Maximum capacity requirements

Why Large V4 and XL V4 work best for Africa-Europe:

- Bandwidth allocations (3,797TB-5,695TB) handle traffic to both continents without overages

- CPU capacity supports diverse workloads (web servers, databases, application servers, caching)

- Memory configurations handle in-memory caching for African latency optimization

- Readily available in Amsterdam for quick deployment

All configurations deploy in 45 seconds to production-ready infrastructure with OpenStack for unified management.

Pricing current as of February 2026 and subject to change. View current pricing.

Network Performance

Amsterdam infrastructure includes:

Bandwidth:

- Generous included bandwidth (1,898TB to 9,491TB depending on configuration)

- No per-GB charges within included allocation

- Covers traffic to both European and African destinations

Latency characteristics:

- <10ms to major European cities

- 40-70ms to North African cities

- 90-140ms to West African cities

- 130-190ms to East/Southern African cities

Reliability:

- Multiple upstream providers

- Automatic failover between providers

- BGP multi-homing for redundancy

- 99.9%+ uptime SLA

Real-World Implementation Example

Let’s walk through a hypothetical scenario showing how this works in practice:

Scenario: Pan-African E-Learning Platform

Company profile:

- Educational video platform serving African students

- Growing European market (diaspora, researchers, international students)

- 100,000 active users (60% African, 40% European)

- 500TB monthly bandwidth (video content)

- Budget-conscious (bootstrapped startup)

Infrastructure decision: Could deploy in both Africa and Europe, but chose Amsterdam single-location approach.

Implementation:

Amsterdam infrastructure:

- Large V4 Cloud Core: $4,298.40/month

- Chosen for excellent Africa-Europe balance

- Readily available in Amsterdam

- 3,797TB bandwidth more than sufficient for video delivery

- Handles origin servers, databases, user management

- Stores all video content

Why Large V4 works well:

- Bandwidth allocation (3,797TB) covers both continents with room to grow

- Capacity handles transcoding, storage, and delivery

- Single location simplifies operations for small team

- Cost-effective for startup budget

CDN layer:

- Cloudflare for edge caching

- African edge locations in South Africa, Kenya, Nigeria

- Caches video content close to users

- ~$500/month additional cost

Performance results:

European users:

- <50ms latency to Amsterdam origin

- Excellent streaming performance

- No complaints about video quality

North African users (Egypt, Morocco):

- ~60ms latency to Amsterdam

- CDN edge in Cairo helps

- Good streaming experience

West African users (Nigeria, Ghana):

- ~110ms latency to Amsterdam origin

- CDN edge in Lagos significantly improves delivery

- Acceptable streaming performance

- Some buffering on slower connections

East African users (Kenya):

- ~140ms latency to Amsterdam origin

- CDN edge in Nairobi helps significantly

- Works well for pre-recorded content

- Would struggle with live streaming

Southern African users (South Africa):

- ~170ms latency to Amsterdam origin

- CDN edge in Johannesburg crucial

- Pre-recorded content works fine

- Live features have noticeable lag

Cost comparison:

Single Amsterdam deployment:

- Infrastructure: $4,298.40/month

- CDN: $500/month

- Total: $4,798.40/month ($57,581 annually)

If deployed in both locations:

- Amsterdam infrastructure: $2,376/month

- African infrastructure: ~$8,000/month (estimated)

- Management overhead: ~$2,000/month

- Total: ~$12,376/month ($148,512 annually)

Savings: $90,931 annually

Business outcome: The cost savings could allow the company to invest in content creation and marketing instead of infrastructure. As they grow to 500,000+ users, they could reconsider adding dedicated African infrastructure, but Amsterdam single-location gets them to market efficiently.

Wrapping Up: Strategic Infrastructure for Two Continents

Serving both Africa and Europe doesn’t always require infrastructure on both continents. Amsterdam’s position at the crossroads of European and African submarine cable networks makes it effective for reaching both markets from a single deployment.

The economics are fantastic. Single Amsterdam deployment costs $51,000-86,000 annually compared to $150,000-240,000 for dual deployment. For mid-market companies entering African markets or serving diaspora populations, this cost difference is significant.

The latency is workable. North and West African markets (where most African internet users live) have 40-140ms latency from Amsterdam. This works well for most applications except competitive gaming and real-time trading. East and Southern Africa have higher latency (130-190ms) but still function for non-real-time applications.

OpenMetal’s Large V4 and XL V4 Cloud Cores are readily available in Amsterdam and optimized for multi-continent deployment. The Large V4 ($4,298.40/month) provides the sweet spot for most Africa-Europe deployments, with 3,797TB bandwidth handling traffic to both continents. The XL V4 ($7,149.60/month) scales to higher capacity for bandwidth-intensive applications.

The approach isn’t universal. If you have millions of users in specific African countries, if you need <100ms latency for competitive gaming, or if regulations require in-country data storage, you’ll need African infrastructure. Amsterdam works as a starting point and cost-effective solution for many use cases, with the option to add African locations as scale justifies the investment.

For companies with users in both Europe and Africa, Amsterdam provides a practical middle ground. Deploy in one location, reach two continents, maintain operational simplicity, and invest saved costs in product development and customer acquisition.

Ready to deploy infrastructure serving Africa and Europe? Explore OpenMetal’s Amsterdam data center or contact the team to discuss your specific Africa-Europe connectivity needs.

Schedule a Consultation

Get a deeper assessment and discuss your unique requirements.

Read More on the OpenMetal Blog