CentOS, CentOS Stream, and Red Hat Fan

I am writing this from the following perspective:

- a long time Red Hat brand advocate

- a long time user of CentOS

- co-founder and advisor/operator at a 20 year old hosting company that helps end customers use CentOS in production for non-enterprise uses

- founder and advisor/operator at startup on-demand infrastructure provider with a flagship instant on OpenStack private cloud based on CentOS Stream

The final puzzle piece. In our private cloud business we have been growing to larger and larger customers. As customers approach “enterprise” spends, they naturally look to offerings like RHEL.

Last week I was fact gathering so I could talk to our team of OpenStack engineers about using RHEL servers for enterprise level customers. I wanted to understand licensing and basic costs first before getting too far. As it turns out, it is pretty hidden like many “enterprise” sales processes like to do even though tech people hate that flow. But still, as a long time fan of Red Hat, I am excited about getting to work with them directly. But then I got distracted by a Red Hat announcement. Yes, that one.

Red Hat Hits Again on CentOS/RHEL Downstream Clones

Red Hat took another swing at RHEL downstream clones. It isn’t clear really what Red Hat is so angry about;

- Is it Oracle repackaging RHEL? That does seem like it cuts into Red Hat’s current enterprise business model but Oracle does a decent amount of upstream work on the Linux Kernel so that helps RHEL.

- Is it Rocky Linux and something personal against Gregory Kurtzer? He is the founder of Rocky but also was a co-founder of CentOS before Red Hat bought it.

- Is it AlmaLinux that has ties to CloudLinux and cPanel which both monetize on top of RHEL clones?

- Something not on this list?

It is hard to say, but I will put forward this idea. I don’t think Red Hat truly understands that the vast majority of CentOS users are not like paying RHEL users and will never be like paying RHEL users. I saw this post from a Red Hatter that is explaining his view on the CentOS to CentOS Stream change. Good article, check it out. CentOS Stream makes sense to me and several other points resonated, but as I read it, it reinforced to me that from an insider’s view a free downstream RHEL clone just doesn’t support their sales funnel. I also read the recent response from Red Hat’s VP of Core Platforms Engineering, Mark McGrath. That also reinforced to me that Red Hat is looking at CentOS users from their Enterprise Software revenue lens.

But… If most CentOS users are nothing like paying RHEL users then why expect them to become paying RHEL users? How about selling them something they want?

Dear Red Hat, it seems like you are not really sure what you have in CentOS. Could you be wasting a great value?

Value of CentOS Users and Other RHEL Downstream Clones

So what do they have from my view. Millions of users of a RHEL derivative that absolutely use it and trust it in production but will almost never graduate to an “Enterprise Use Case”. So what does that mean then?

In the posts above both mention some expectation of Red Hat’s acquisition of CentOS yielding a key marketing goal of having a percentage of CentOS users convert to RHEL in a predictable funnel. Quote from the Red Hat VP, Mark, “The generally accepted position that these free rebuilds are just funnels churning out RHEL experts and turning into sales just isn’t reality.”

I am not sure who might be in this group that has the “generally accepted position” he spoke about, but I am not. And if you were going to have that happen, it would be a specifically created funnel with an in-depth understanding of the users that would move through that funnel.

Well, I happened to have just gone down that rabbit hole/funnel – but first, the main mission – I hope to get to the right eyes in Red Hat for the following:

Dear Red Hat,

With millions of users on a downstream CentOS/equivalent, is there not a business model that gets you the scale you need to make it worth while? I get that it is likely $100s of millions a year. If you did figure it out, then inside Red Hat you would look at these millions of users with more care as your open source passion would match another viable business goal.

A follow up to that. If it doesn’t fit your model or isn’t a big enough revenue bump for Red Hat, can you work on friendly terms with the downstream cloners so they shift resources to CentOS Stream as part of the acknowledged revenue or value those businesses get from their RHEL clones? There is clearly need from end users, as you can see by the reaction, but if the business models are too small for your company, why damage the ecosystem and your brand by taking this stance? Lets come back to that later.

CentOS Upgrade Funnel – Rabbit Hole

As I was already digging into Red Hat’s purchase funnel, I was half way down the purchase funnel rabbit hole. So:

- How would someone actually go about getting a RHEL license and OS to replace their CentOS?

- How much does it cost?

- Would the cost be something a small business running one server would mind absorbing?

RHEL for Single Servers via a-la-carte Purchasing

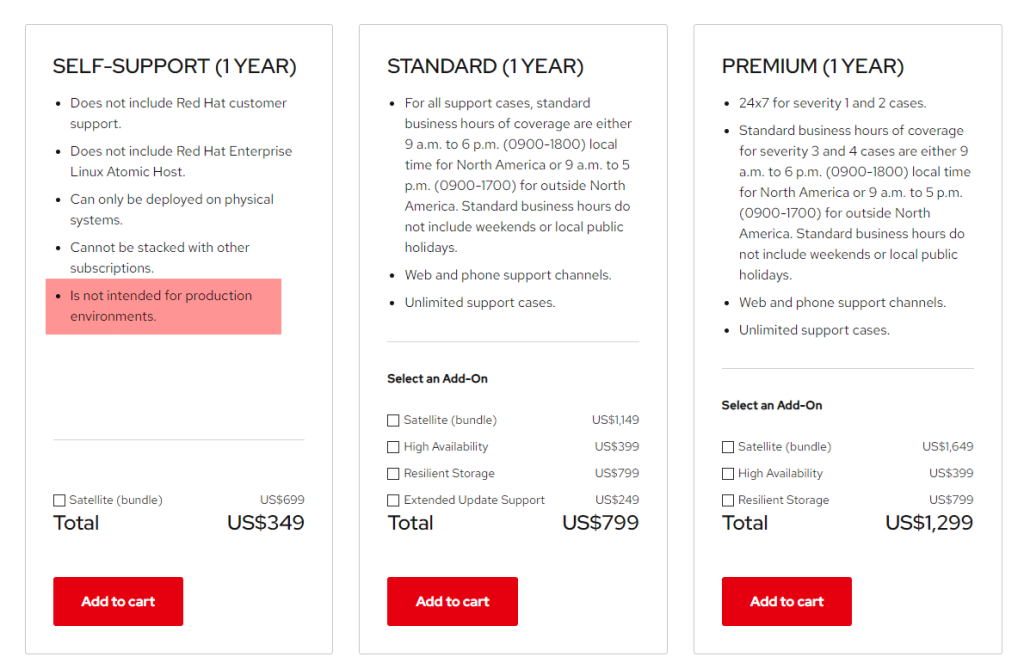

As soon as I started this, my immediate take was Red Hat’s “merchandising” team has made a positioning decision (or classic mistake) that can be really tricky to navigate.

The screenshot is from their store. I highlighted the key item. Essentially, the marketers designing this flow got so fixated on upselling a potential buyer that they have inadvertently made their base product look weak.

So weak that it actually doesn’t compete with the downstream RHEL clones. The current CentOS 7 RHEL clone, for example, is intended for production environments and is/was used in production for millions of mostly non-enterprise use cases.

So if I wanted to “upgrade” my CentOS to RHEL but I don’t need support – so I must use an Operating System that “Is not intended for production environments.”? Ok, now what? Well, first, if this was intended, ok, but if one of those passionate Red Hatters look at this and say, yeh, I agree, that doesn’t make sense – well, maybe an opportunity?

How much does moving from CentOS to RHEL for a single server cost?

The Satellite bundle is for running many servers so you don’t need that for a small deployment. Most small use cases will not need the Support as the server they are using is on a cloud provider or hosting company. Looks like basically $349/yr or, as most usage is monthly, at about $29/mo.

Would a small business absorb this for their use case?

My experience with users of RHEL under the CentOS moniker are not enterprise. They are not running enterprise workloads and do not have enterprise dollars. They are running small servers for everything from basic cloud tools to webservers to VPNs to personal applications.

Running a decent size set of websites and email from a small VPS with cPanel on it will cost a company from $60 to $120/mo. Add the extra $29 for a significant percentage increase but not that much in real dollars.

Yes, a good chunk of small businesses would not find that too much balanced against the cost of evaluating other OSes and having to move every 3-4 years between OSes. Does it mean that is the exact price point that would maximize sales? That needs more thought and analysis of how the flow will work. But it is close.

Monetizing CentOS Users According to CentOS Use Cases

Lets follow the theme of monetizing CentOS users. One of the reasons the market is so vibrant (and angry at the moment) is because there is a big need that was fulfilled by CentOS and its replacements. Just because they are not enterprise does not mean they don’t have real needs and, as an aggregate force, possess huge purchasing power.

Does it eclipse a RedHat/IBM “meaningful number to our business” goal? Does the system have to be highly automated and not match an enterprise process, likely yes. But, can you find ideas worth $10 million a month almost overnight? $120M ARR? My bet is yes if you all give it some true brain cycles.

Big challenge is that much of the RHEL marketing is that anything but RHEL is “Not for production use.” That must be reframed into something like:

- CentOS is great to get started but CentOS SMB (so creative, right?) is for long term non-enterprise use

- CentOS SMB is not for enterprise production use, get RHEL

Anyways though, the main idea is that if the proud and passionate Red Hatters give some true thought to the problem they will come up with something, I really believe it. And would we pay for it? Yes, but our customers can’t pay enterprise pricing for non-enterprise uses – it just is what it is. So:

My final thought – Red Hat has been a great open source company for a long time. For sure, this “left turn” isn’t consistent with that. Will it push me over the edge like it did many? No, I don’t think so. For me, it will really depend on if CentOS Stream is what many have stated it will be – stable and reliable – while also enabling more ownership and responsibility sharing to occur.

More on the OpenMetal Blog…

Private Cloud Fundamental Advantage vs Public Cloud

In this blog:

A search on “public cloud advantages” will nearly always include some statements about public cloud being “less expensive” than alternatives.

AWS vs GCP: Choosing The Right Cloud Platform

In this blog:

AWS and GCP are leading players in cloud computing, offering a wide range of services and attractive pricing. However, choosing the right platform requires … read more

OpenStack vs VMware: Cost Considerations

In this blog:

Without question, VMware has a good reputation for cloud security and virtualization within a single management framework. I will even admit to having been an active promoter…read more

Test Drive

For eligible organizations, individuals, and Open Source Partners, Private Cloud Cores are free to trial. Apply today to qualify.

Subscribe

Join our community! Subscribe to our newsletter to get the latest company news, product releases, updates from partners, and more.